how much federal tax is taken out of my paycheck in illinois

See how your refund take-home pay or tax due are affected by withholding amount. Illinois Hourly Paycheck Calculator.

Small Business Taxes Payroll Surepayroll

Current FICA tax rates The current tax rate for social security is 62 for the employer and 62 for the employee or 124.

. Estimate your federal income tax withholding. Rates are based on several factors including your industry and the amount of previous benefits paid. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck.

As of January 1 2022 the Illinois unemployment tax rate ranges from 0725 to 7625. How Much Federal Tax Is Taken Out Of My Paycheck In Illinois. Use this tool to.

Enter the amount figured in Step 1 above as the total taxable wages on line 1a of the withholding worksheet that you use to figure federal income tax withholding. Illinois tax year starts from july 01 the year before to june 30 the current year. What percentage is taken out of paycheck taxes.

Although you might be tempted to take an employees earnings and multiply by 495 to come to a withholding. The wage base is. How much is 75k after taxes in.

Explore our full range of payroll and HR services products integrations and apps for businesses of all sizes and industries. Unemployment Insurance UI supplies funding for the Illinois Department of Employment Security IDES which pays benefits to the unemployed. Fast easy accurate payroll and tax so you can.

Our calculator has recently been updated to include both the latest Federal Tax Rates. There is an Additional Medicare Tax of 09 percent withheld from employees paychecks if they earn more than 200000 annually regardless of their income tax filing. Personal income tax in Illinois is a flat 495 for 20221.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4. You are able to use our Illinois State Tax Calculator to calculate your total tax costs in the tax year 202223. How It Works.

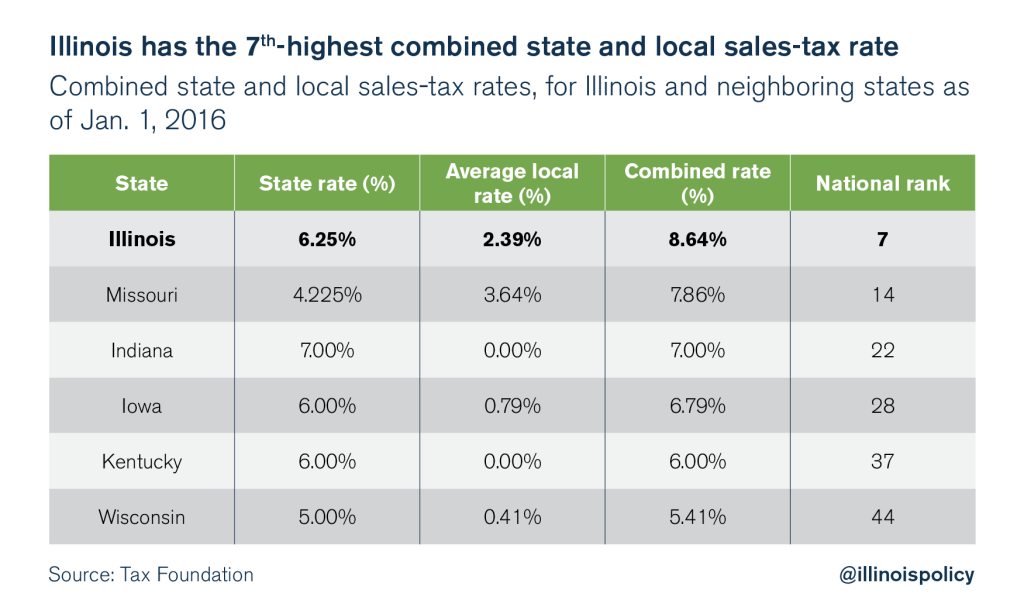

Illinois Is A High Tax State Illinois Policy

Illinois Paycheck Calculator Smartasset

City Of Springfield Home Of Abraham Lincoln

Your Take Home Pay Gets A Boost This February Ways And Means Republicans

How To Calculate Payroll Taxes Methods Examples More

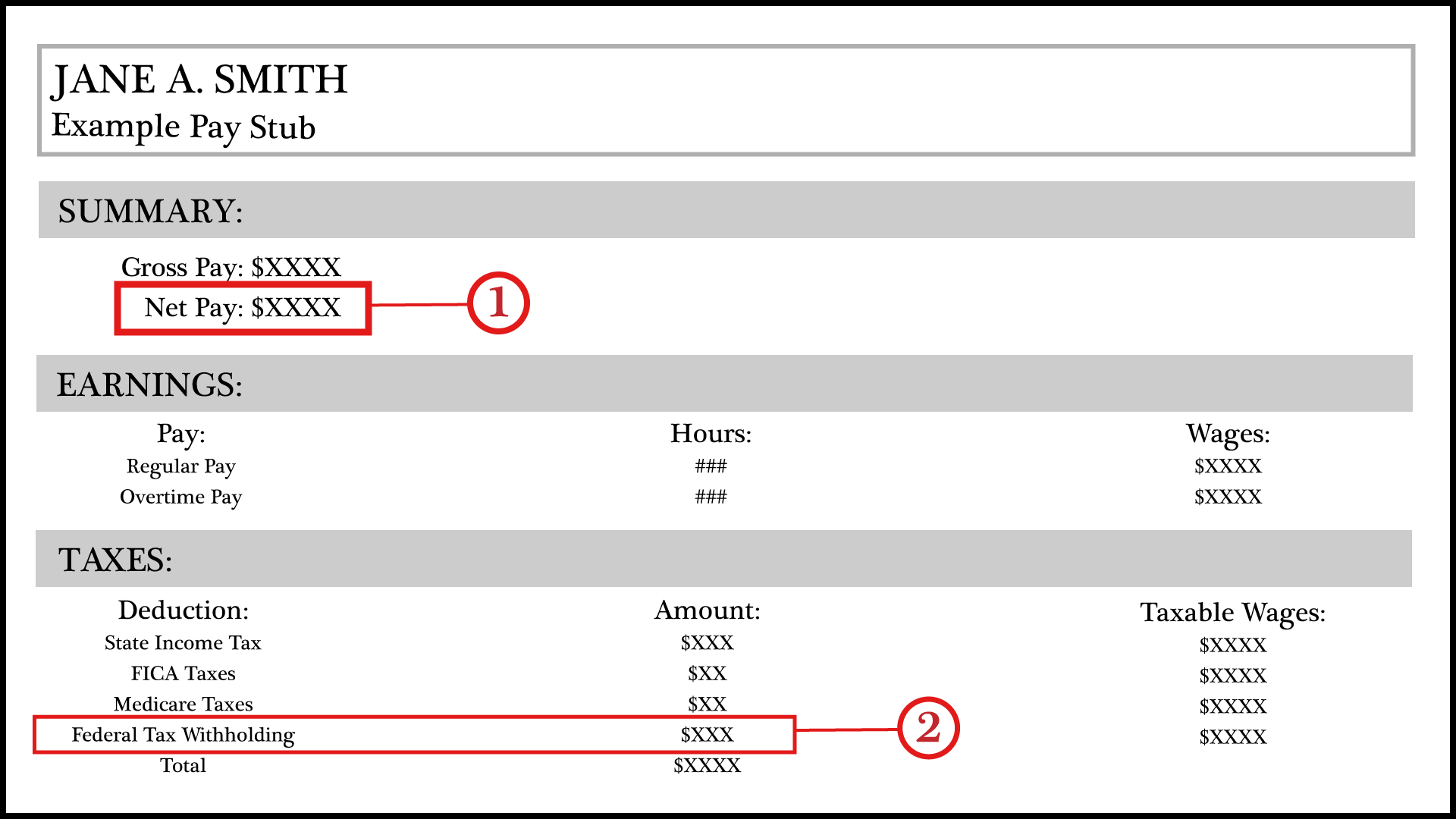

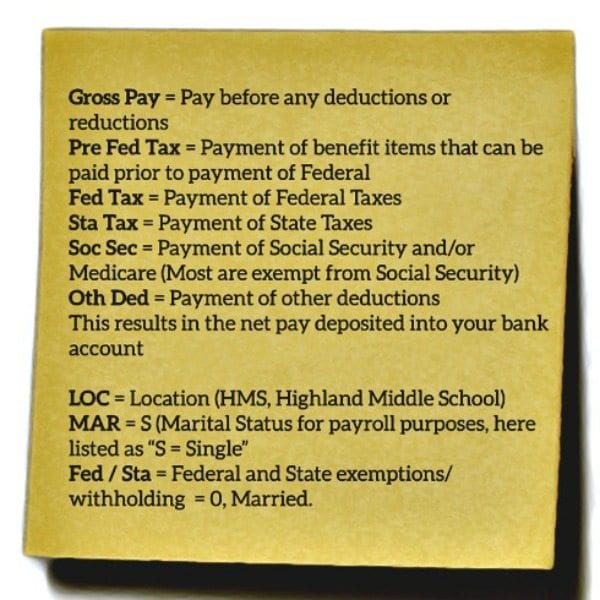

Your Paycheck Tax Withholdings And Payroll Deductions Explained

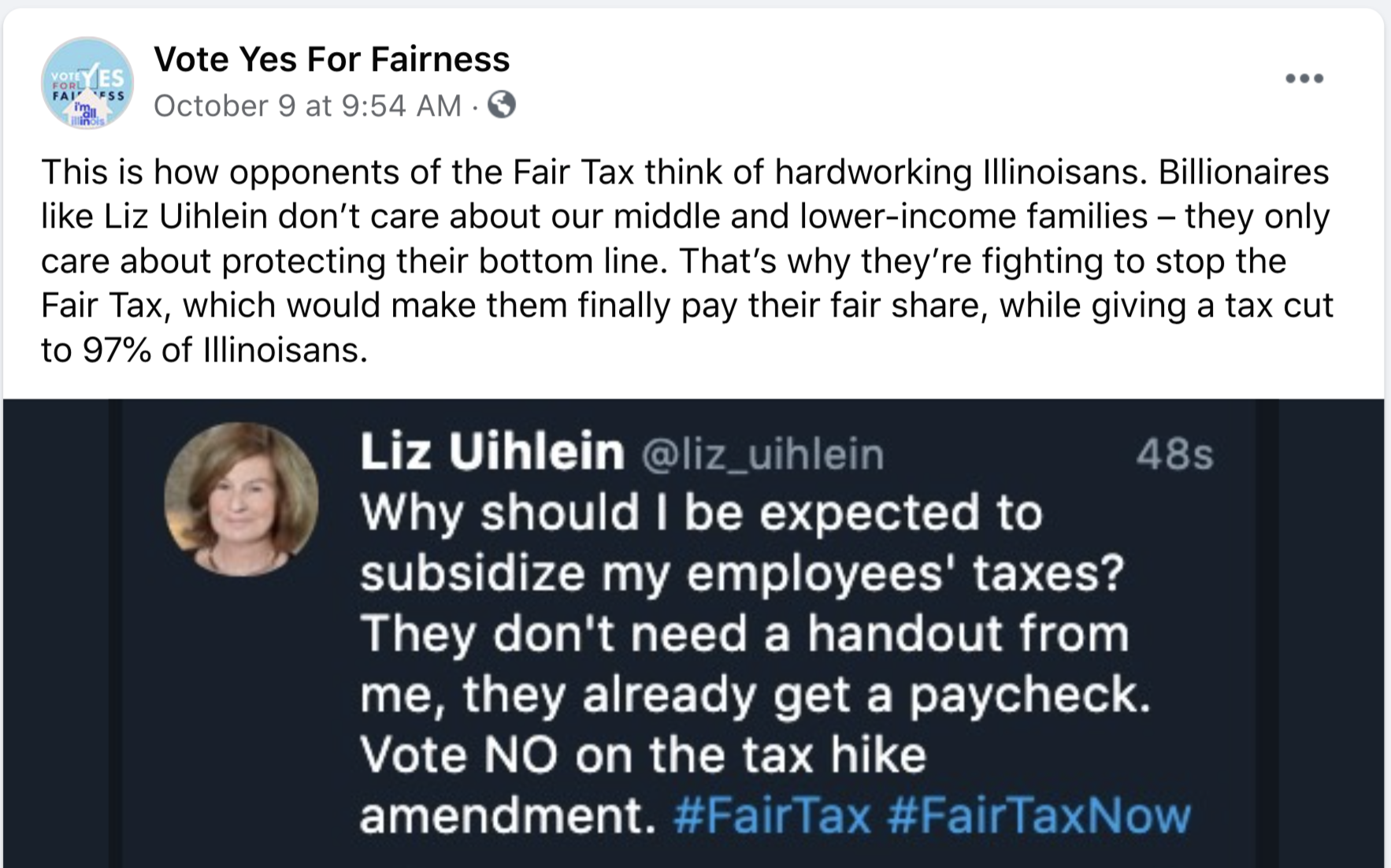

Pritzker Fair Tax Group Pays Over 10 000 To Push Fake Tweet

2022 Federal State Payroll Tax Rates For Employers

State Conformity To Cares Act American Rescue Plan Tax Foundation

Free Illinois Payroll Calculator 2022 Il Tax Rates Onpay

Paycheck Check Up Financial Advisors Reps In Illinois Indiana

Paycheck Calculator Take Home Pay Calculator

New Tax Law Take Home Pay Calculator For 75 000 Salary

Illinois Paycheck Calculator Smartasset

How Much Money You Take Home From A 100 000 Salary After Taxes Depending On Where You Live

Illinois Income Tax Calculator Smartasset

Illinois Paycheck Calculator Adp

Understanding Your Teacher Paycheck We Are Teachers

Illinois Tax Rates Rankings Illinois State Taxes Tax Foundation